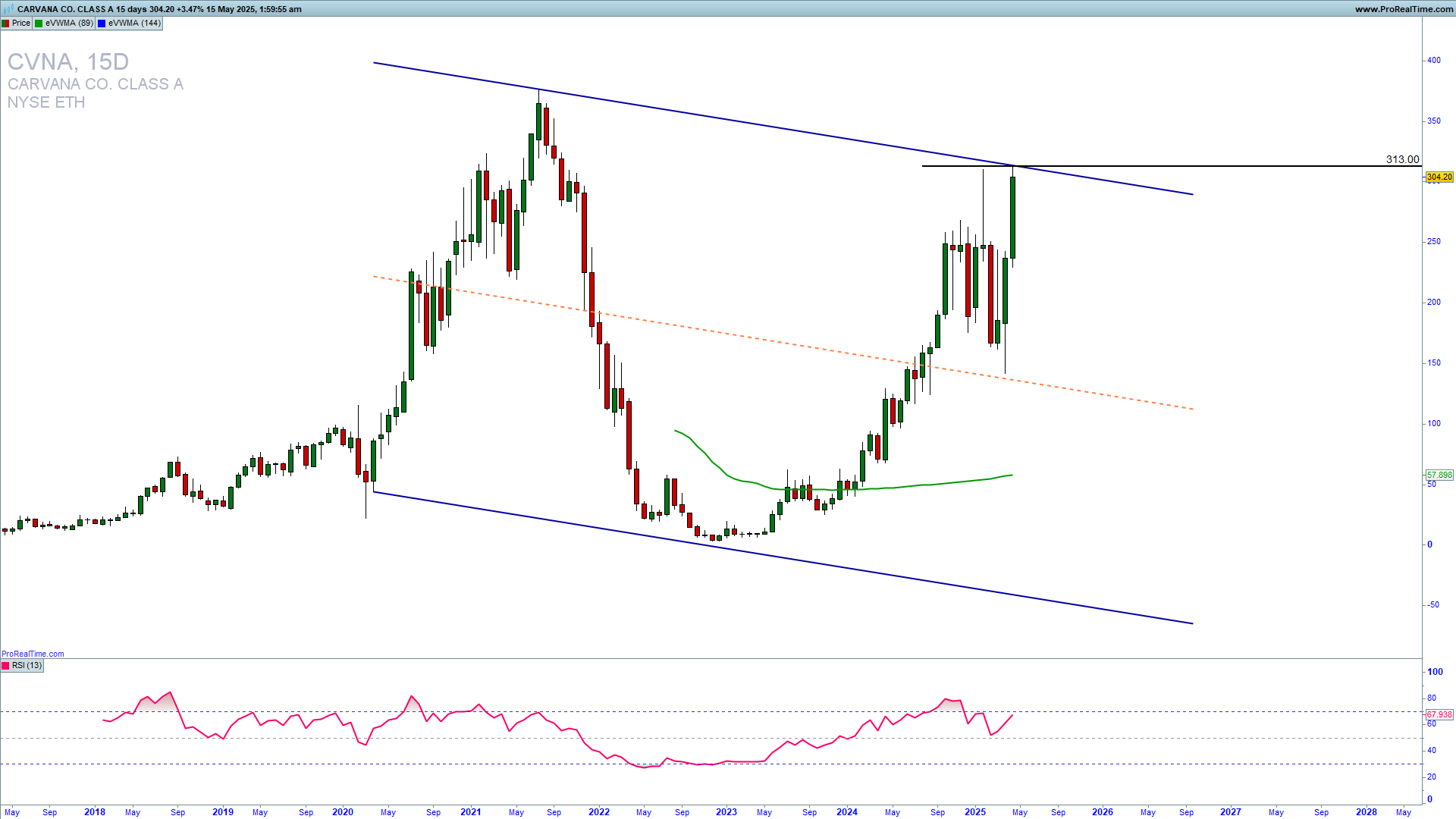

CVNA reached a high of 313, which is a high of the sideways channel. This can lead to a potential reversal lower to 200 in the medium-term as the stock is still in the consolidation channel long-term. If you are not already in the buying position, look for a low-risk short trade entry. Go with a long trade entry only in the case of a confirmed break above 315. Learn to Trade Stocks profitably.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

How can we trade this?

It is a fact that a strong upside resistance for Q2 2025 is 315, and if we see a confirmed break higher, you can open a high probability long trade entry. Open short trade with a SL above 330 to target 200. You can buy put options as well. For inquiries about account management or copy trading, please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING DISCOUNTED