Daily market overview EURUSD, USDJPY, AUDUSD, NZDUSD, USDCAD, GBPUSD, BITCOIN

Click on the chart image to enlarge it

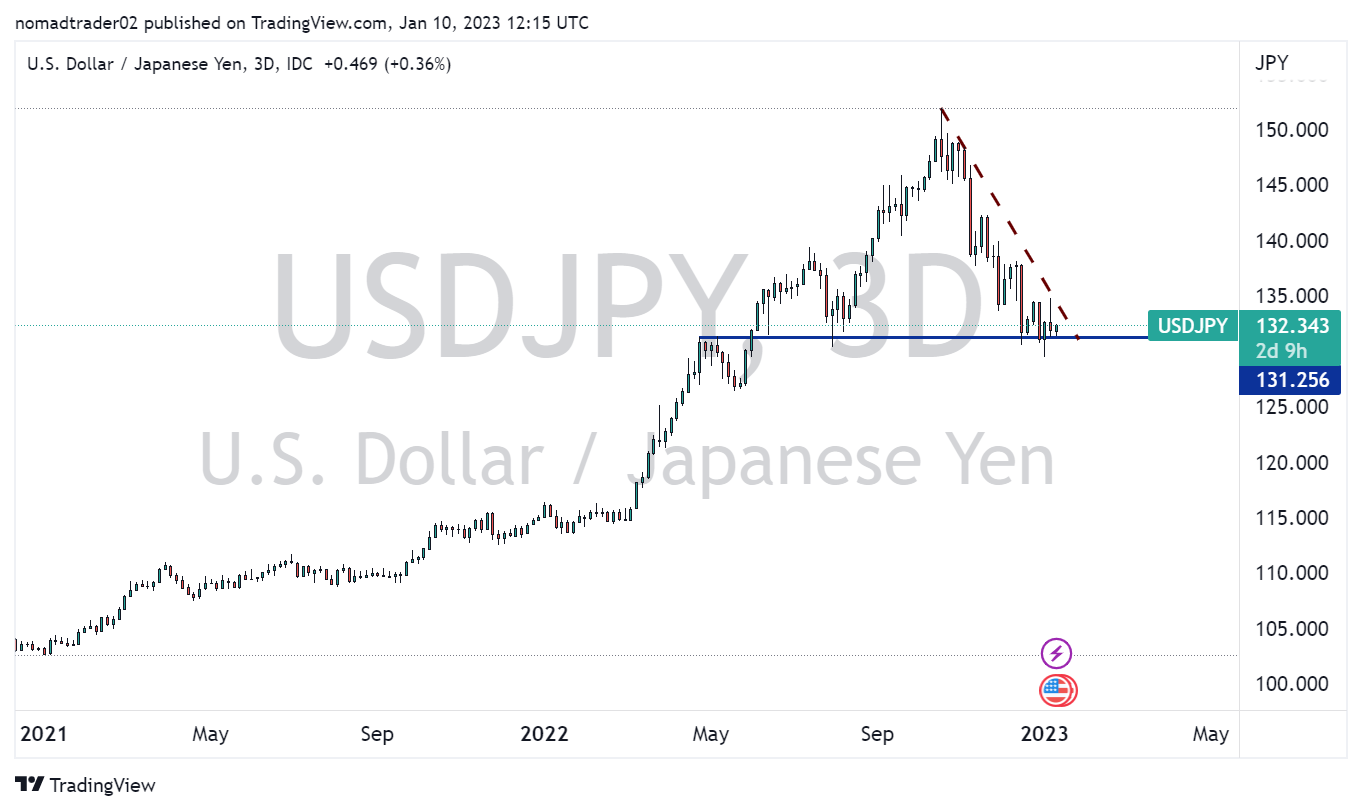

USDJPY

The pair is breaking for the first time above strong wedge resistance 118. It is reaching 2015 extreme 125 and is breaking above it. Look at this like the final stage swing higher. We have a rejection from 150 and we could see a possible pullback to 137 and lower which is happening as we have a retest of a broken rising wedge and a continuation lower.

Note: stay away from the trade entries for now

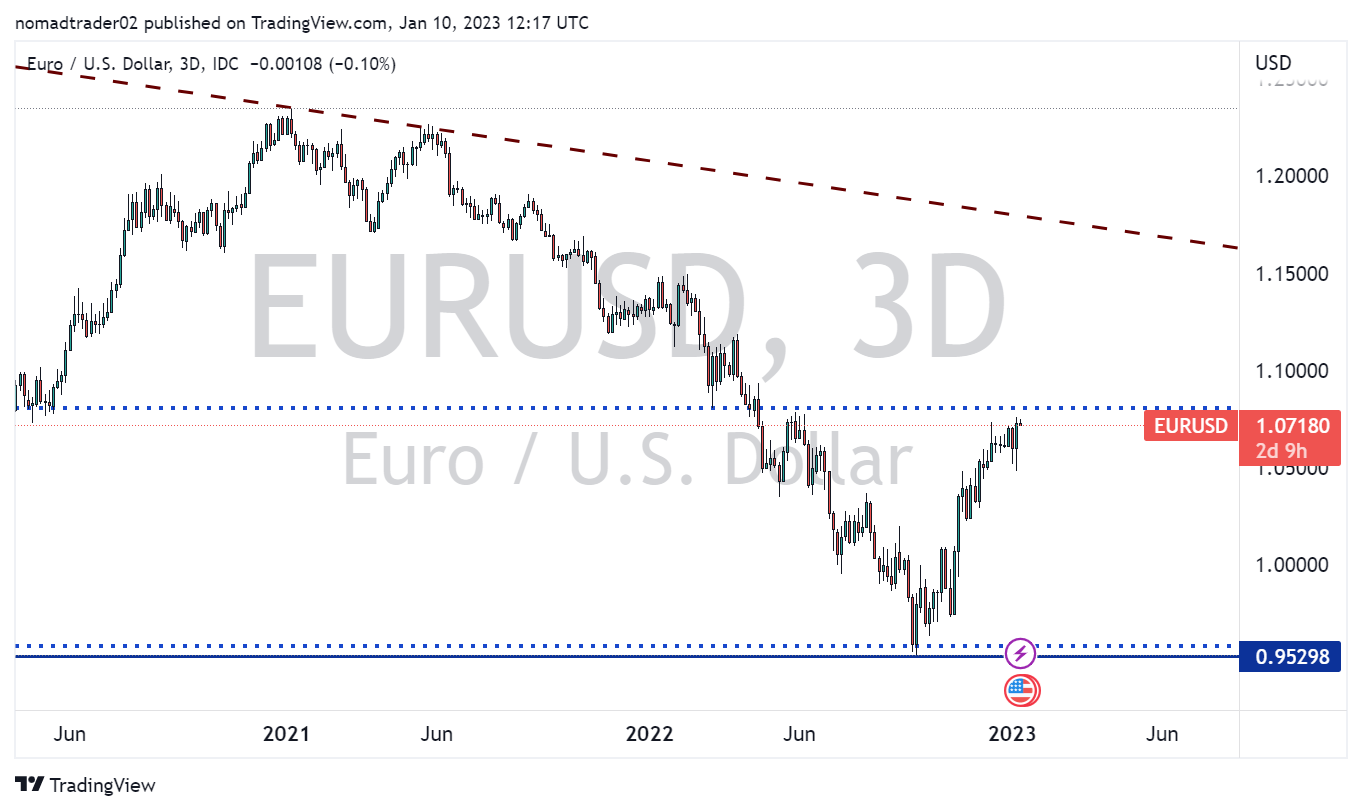

EURUSD

The pair is bouncing off the strong wedge support/resistance of 0.9600 and could go higher to 1.0000 retests which we have and a break above.

Note: look for the long trade entries upon a break above 1.07500

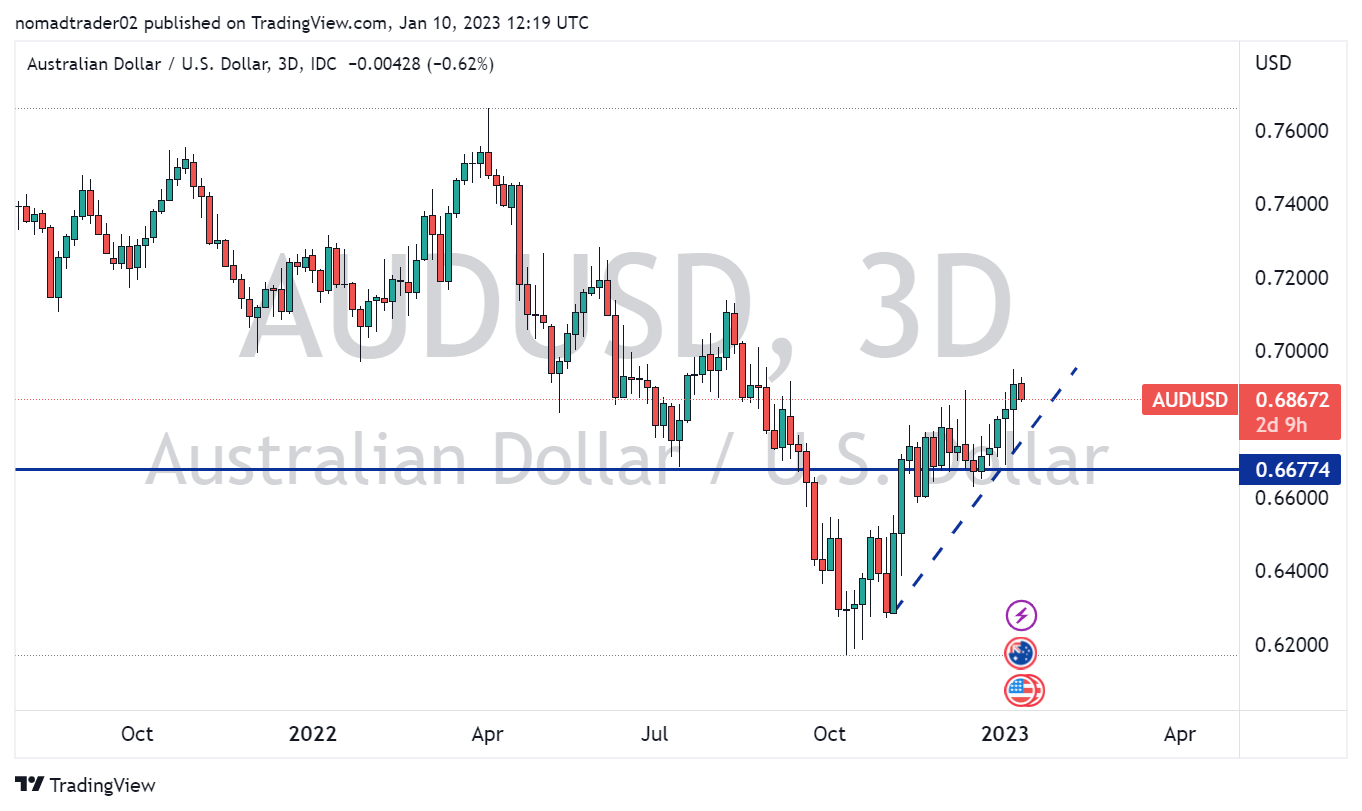

AUDUSD

The pair is testing the strong resistance of 0.6180 for a possible bounce and a test of the upside resistance of 0.7000. Acceleration higher is expected above 0.6450 and we have it now.

Note: look for the long trade entries with a stop loss below 0.6800

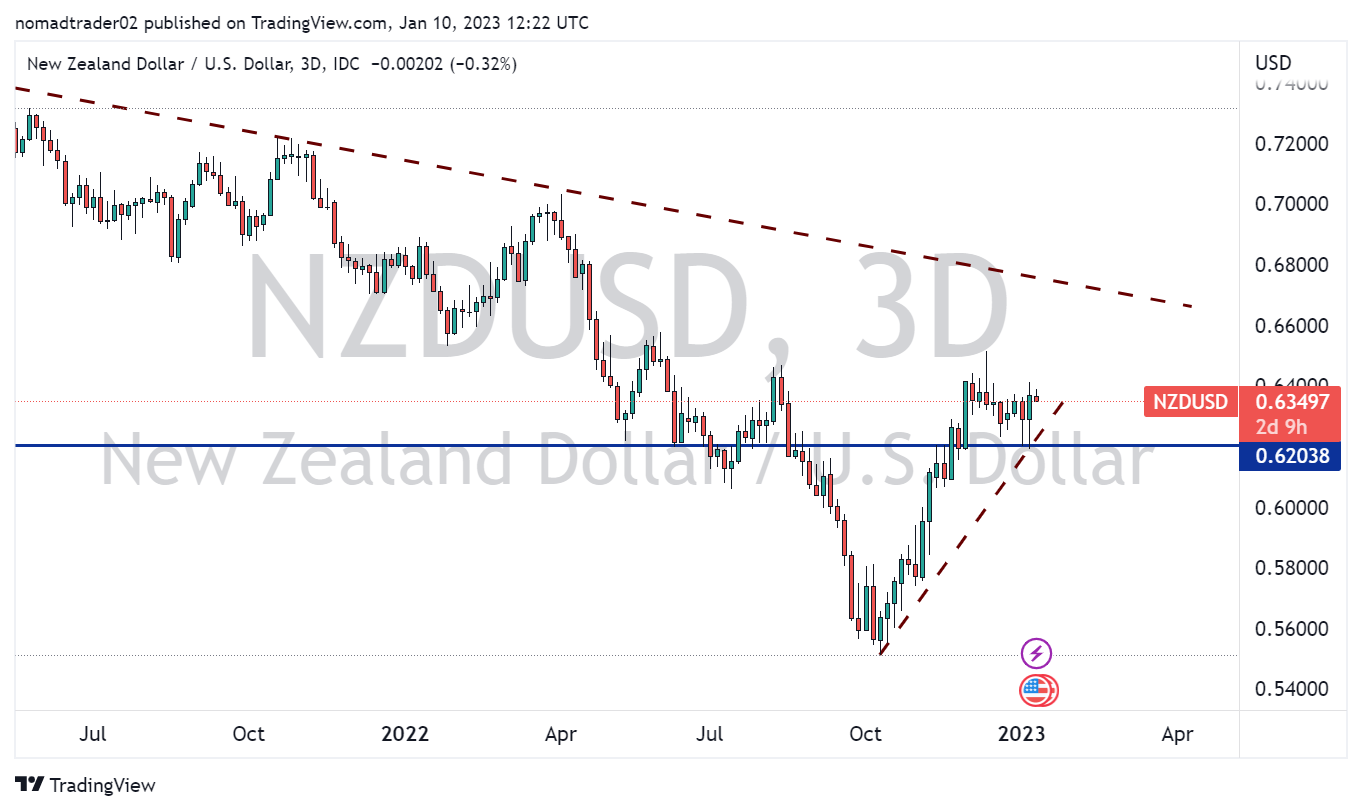

NZDUSD

The pair tests the strong support of 0.5600 and bounces for a test of 0.6000 and higher which we have now.

Note: look for the long trade entries with a stoop loss below 0.6200

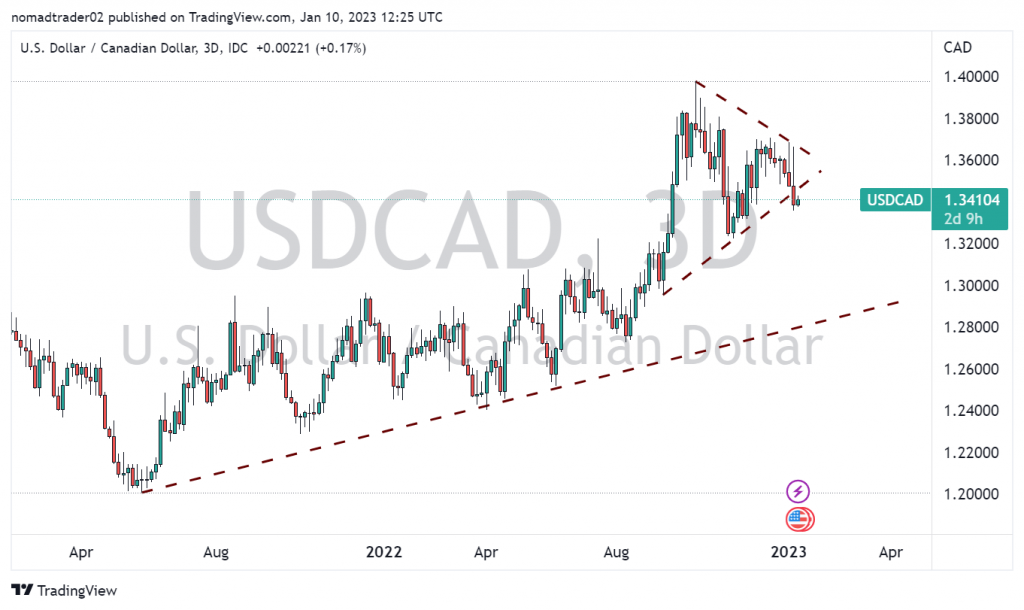

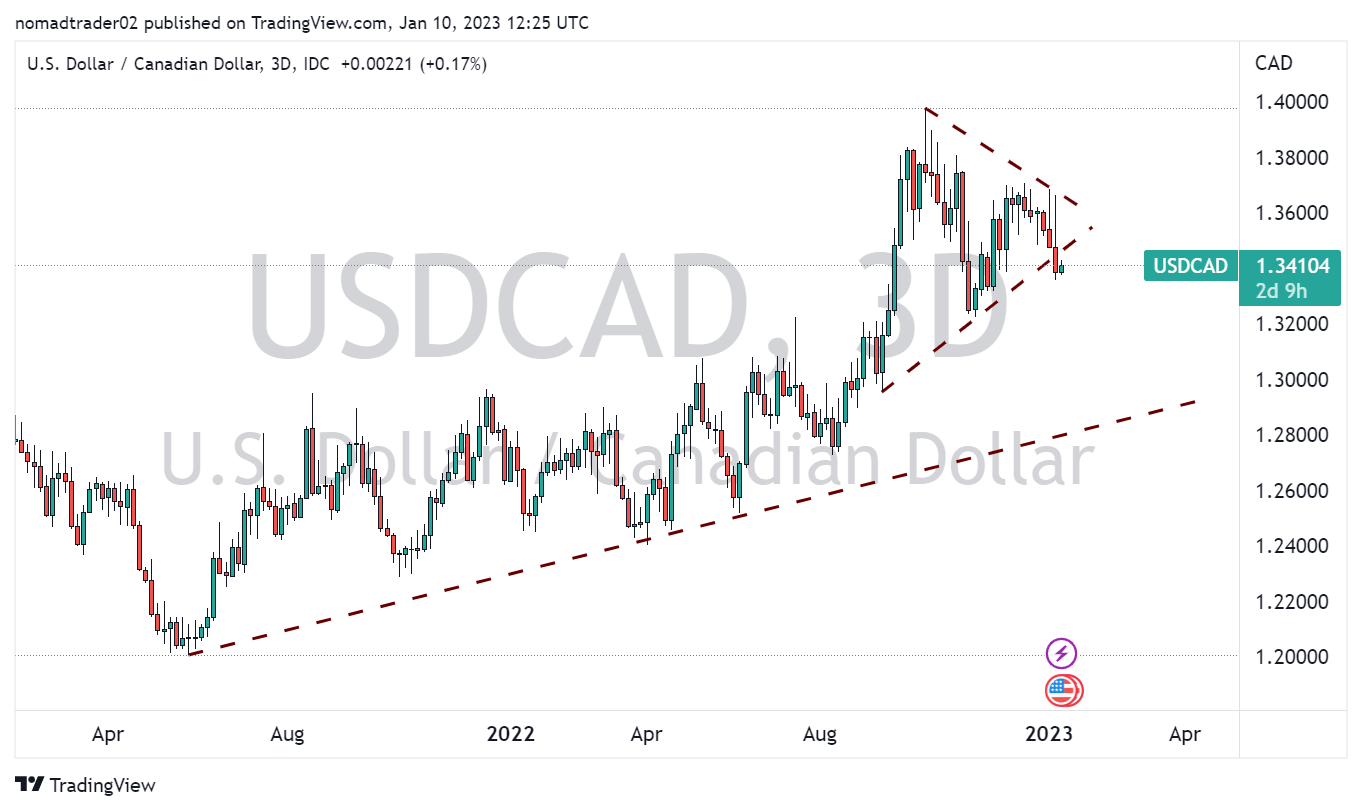

USDCAD

It is rejected from a solid long-term resistance of 1.3900 after the consolidation in the parabolic move. We have a swift reversal targeting 1.3000. Look for a downside continuation after this breakout lower and retest.

Note: look for the short trade entries with a stop loss above 1.3500

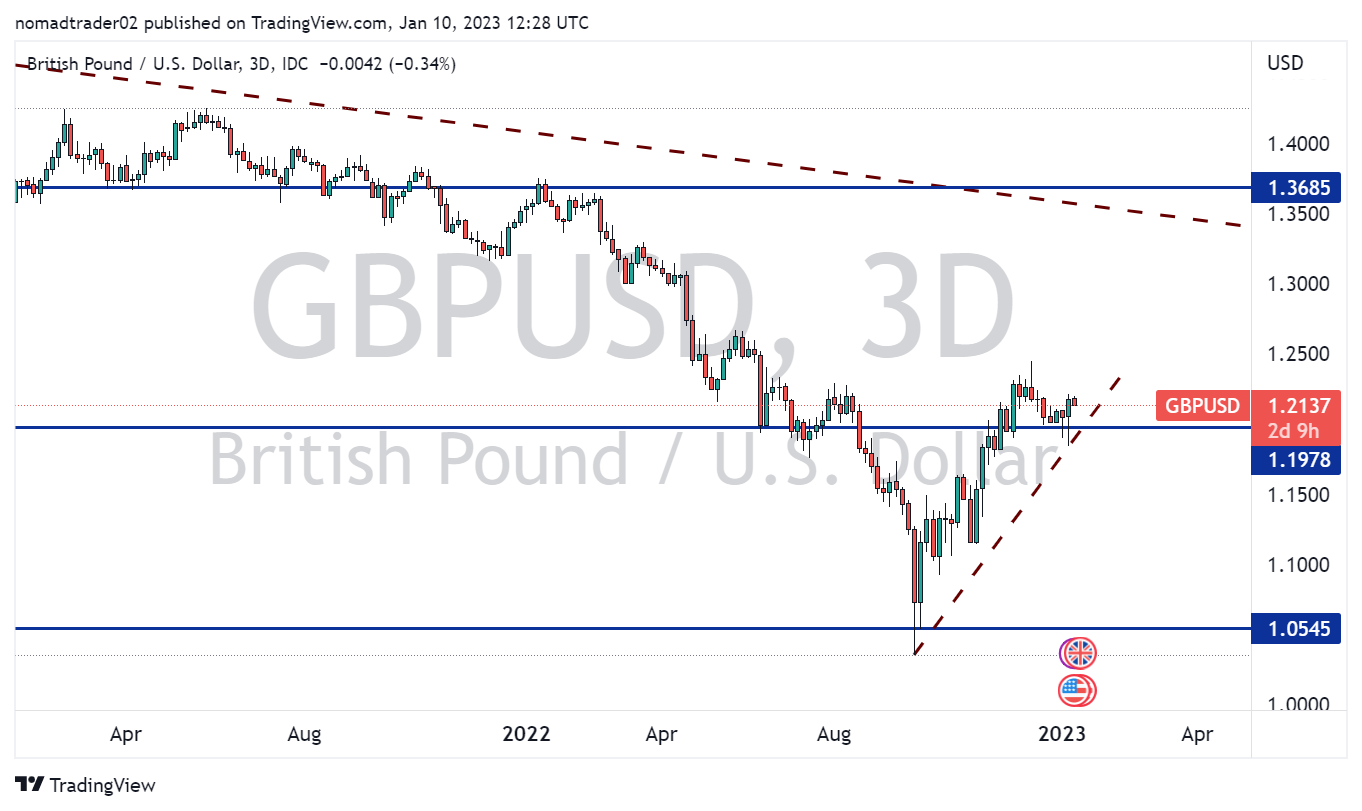

GBPUSD

The pair is bouncing off the long-term wedge support of 1.04000 and is jumping higher for a 1.1500 retest. And we have a break above 1.1500 confirming a complete upside reversal.

Note: long trades with a stop loss below 1.1980

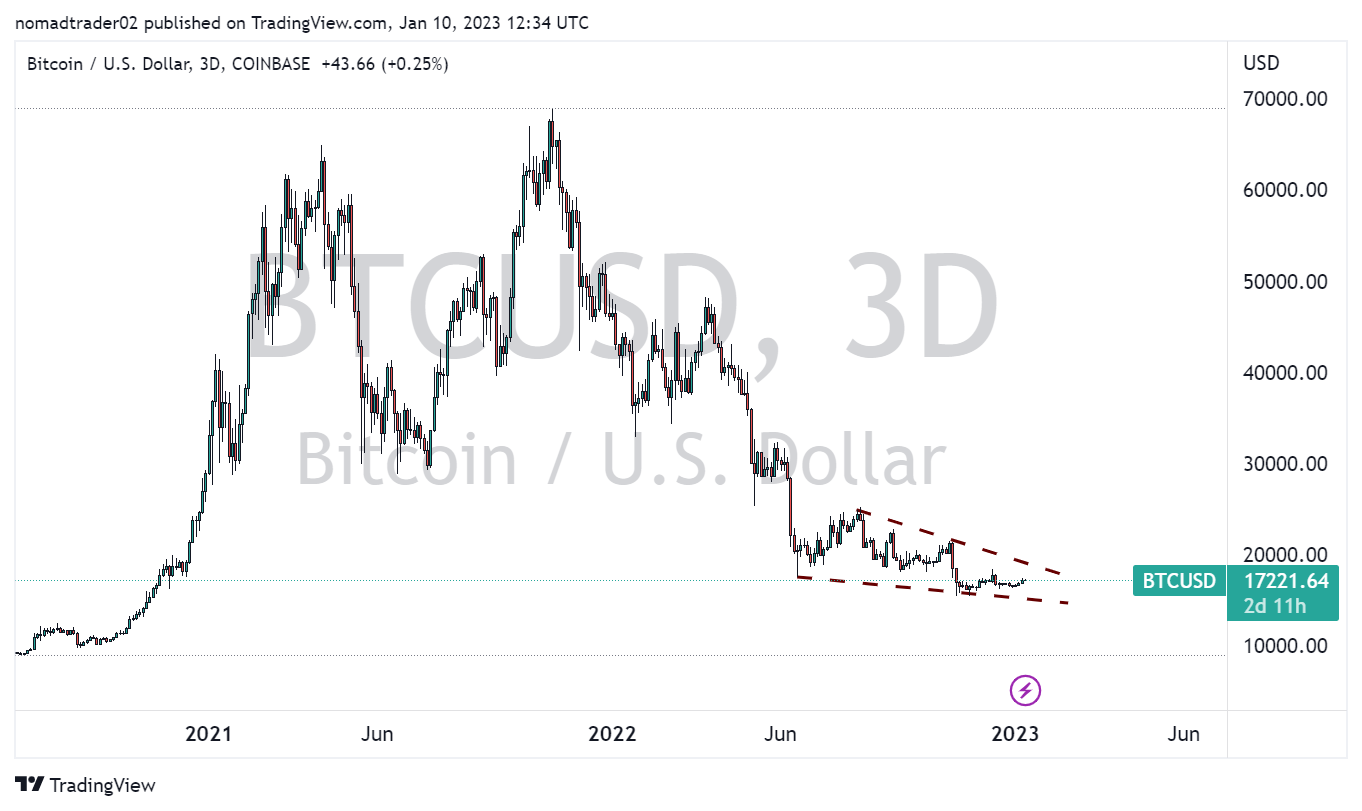

Bitcoin

The instrument tests the substantial downside of 16000 resistance.

Note: look for the long trade entries with a stop loss below 16000