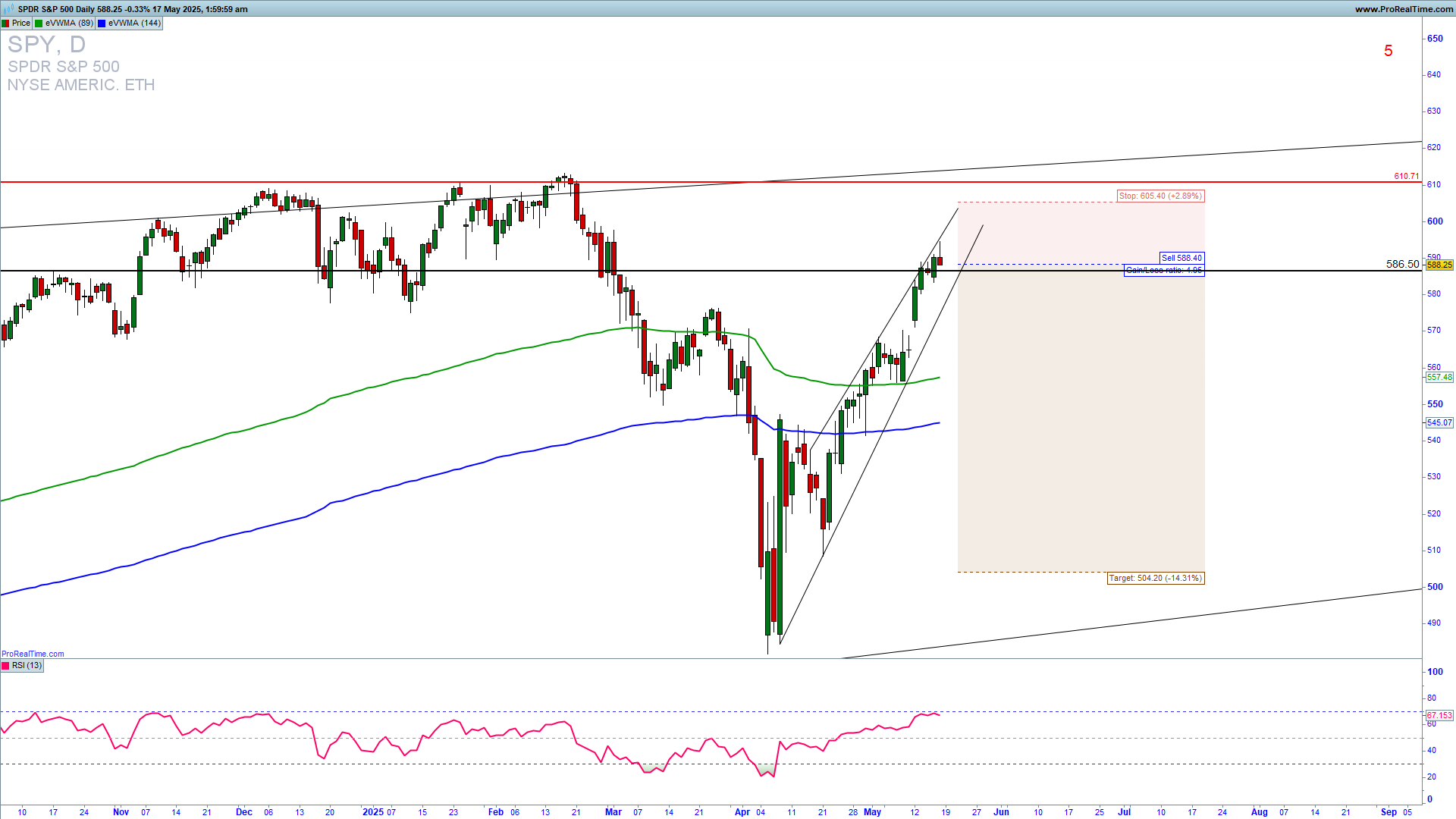

SPY is possibly reaching the peak of a long-term five-wave pattern. A rejection from the 590-600 zone will lead to a reversal downside and a test of the 500 uptrend line. The historic bounce from 480 does not mean that the downside has been finished. Although we could see a new high, a reversal lower from current levels is not excluded; therefore, you need to be cautious with the long trade entries. Learn to Trade ETFs profitably.

The SPY weekly chart is revealing a double top neckline retest 586 level. A break above this resistance is needed for an upside continuation and a test of the 610-630 zone. Rejection here or an overthrow with a break below 580 will give us a good short trade entry. If we get a break above 586, we could see the extension higher, but the upside seems to be limited by long-term channel resistance.

GET TRADE SETUPS IN YOUR INBOX

How can we trade this?

It is a fact that a strong upside resistance for Q2 2025 is 586, and if we get a confirmation of a reversal higher and a sustained extension above it, we could see a strong upside continuation to 610. You can try with a short-trade entry with SL above 605. If the SL will be taken reverse to a long trade entry. For inquiries about account management or copy trading, please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING DISCOUNTED