The tariff news initially drove safe-haven buying, but silver’s decline contrasted with gold’s performance, which hit a record high of $3,167.84 before reversing after the White House clarified exemptions for key commodities like gold and copper.

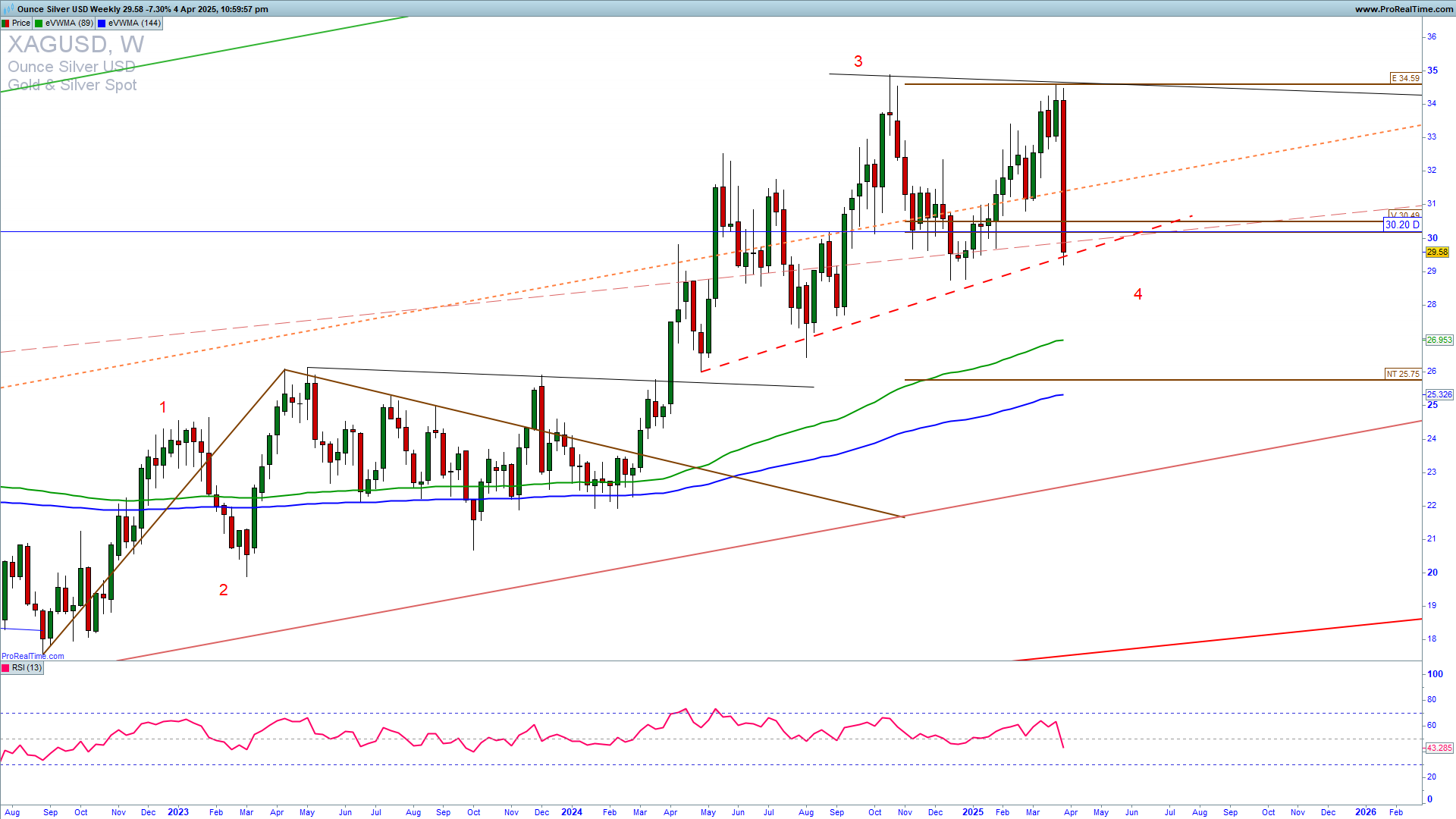

XAGUSD has recently been rejected from the 34.65 high and is pulling back. This level represents a possible third short-term Elliott upside wave top and the beginning of a fourth correctional wave, which proved right. We can see now a complex consolidation between 29 and 34 before a new wave higher. Learn to Trade CFDs profitably.

KNOWPO TRADING SYSTEM TRAINING INTRO FEE!

VIRTUAL TRADING ROOM TWO WEEKS ACCESS!

XAGUSD’s weekly chart below reveals a consolidation support of 29. Allow a possible drop to 29 before a swing higher. In the case of a bounce early next week from 29.40, look for possible short-term and long-term trades. A significant confirmed break below 29 will invalidate the upside swing.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

How can we trade this?

It is a fact that a strong downside resistance for Q2 2025 is 29, and If we get a confirmation of a breakout and a sustained extension below this level, we could see a strong continuation lower in the extended fourth short-term Elliott Wave. You can try with a long-trade entry here first with an SL below 29. In the case that your position is stopped, reverse to short trade. For inquiries about account management or copy trading, please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING DISCOUNTED