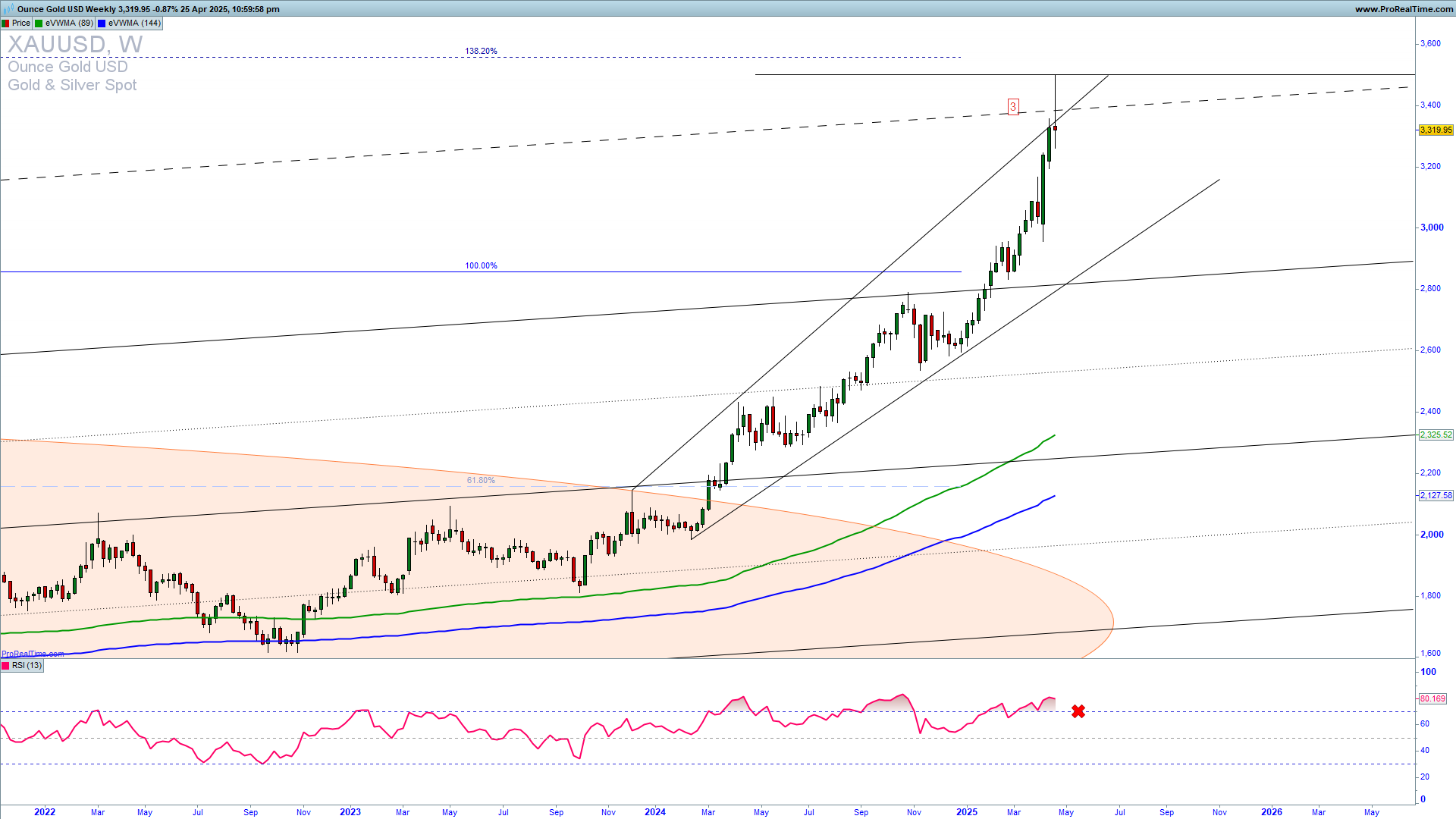

XAUUSD has recently been rejected from 3500 and is reversing lower. This level is 138.2% Fibonacci extension and a possible third long-term wave top, and also the Andrews Pitchfork channel resistance. This could be a pullback into a fourth long-term upside wave before an extension higher in the fifth wave. Learn to Trade CFDs profitably.

KNOWPO TRADING SYSTEM TRAINING INTRO FEE!

The XAUUSD weekly chart below reveals a broadening wedge and a rejection from its upside resistance. From here, I am looking at a possible swing lower to 2800, which is the strong upside resistance of a broadening wedge. Only a break above 3500 will invalidate the downside reversal and a pullback in the fourth long-term Elliott Wave.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

How can we trade this?

It is a fact that a strong upside resistance for Q2 2025 is 3500, and if we get a confirmation of a reversal lower and a sustained extension below 3300, we could see a deeper pullback into 2800. You can try with a short-trade entry with an SL above 3400. You can buy put options as well. For inquiries about account management or copy trading, please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING DISCOUNTED